With AI in financial market analysis, delve into a realm where cutting-edge technology transforms how we understand market dynamics, offering unparalleled insights and opportunities for informed decision-making.

Explore how AI algorithms decode market trends, compare traditional methods with AI-powered tools, and unravel the impact of market volatility analysis on investment strategies.

Introduction to AI in Financial Market Analysis

Artificial Intelligence (AI) plays a crucial role in analyzing financial markets by utilizing advanced algorithms to process vast amounts of data and identify patterns that may not be apparent to human analysts. These AI algorithms have the capability to analyze market trends, predict future movements, and make informed decisions based on historical data and real-time information.

Role of AI Algorithms in Market Analysis

AI algorithms are employed in financial market analysis to sift through large datasets, detect correlations, and uncover trends that can help traders and investors make more informed decisions. These algorithms can analyze historical price movements, news sentiment, social media data, and other relevant factors to identify potential opportunities or risks in the market.

Benefits of Using AI in Financial Market Analysis

- Increased Efficiency: AI can process data at a much faster rate than humans, allowing for quicker analysis and decision-making.

- Improved Accuracy: AI algorithms can analyze data objectively and without bias, leading to more accurate predictions and insights.

- Risk Management: AI can help identify potential risks in the market and implement strategies to mitigate them, reducing the chances of losses.

- Adaptability: AI can adapt to changing market conditions and adjust strategies accordingly, providing a more dynamic approach to trading and investing.

AI Applications in Market Research

AI has revolutionized market research in the financial sector by providing advanced tools and techniques to analyze vast amounts of data quickly and accurately. Let’s explore some examples of AI tools used for market research in the financial industry and compare them with traditional methods.

AI Tools for Market Research

AI-powered tools like natural language processing (NLP) and sentiment analysis are used to analyze news articles, social media, and other textual data to gauge market sentiment and make predictions. These tools can process and interpret large volumes of unstructured data in real-time, providing valuable insights for traders and investors.Other AI applications include machine learning algorithms that can identify patterns and trends in historical market data to forecast future price movements.

These algorithms can analyze market trends, price fluctuations, and trading volumes to generate predictive models that help optimize investment strategies.

Comparison with Traditional Methods

Traditional market research methods often involve manual data collection, analysis, and interpretation, which can be time-consuming and prone to errors. AI-powered market research, on the other hand, automates these processes, saving time and improving accuracy.AI tools can analyze data at a much faster pace than humans, enabling traders and investors to make informed decisions in real-time. Additionally, AI algorithms can process vast amounts of data from multiple sources simultaneously, providing a comprehensive view of the market that would be impossible to achieve with traditional methods.

Enhanced Speed and Accuracy

AI enhances the speed and accuracy of market research processes by automating repetitive tasks and analyzing data more efficiently. For example, AI algorithms can scan through thousands of financial documents, news articles, and social media posts in seconds, identifying relevant information and trends that could impact market performance.Moreover, AI-powered predictive models can analyze complex data sets and generate accurate forecasts with minimal human intervention.

By leveraging AI in market research, financial institutions can gain a competitive edge by making data-driven decisions based on real-time insights and predictive analytics.

Market Volatility Analysis with AI

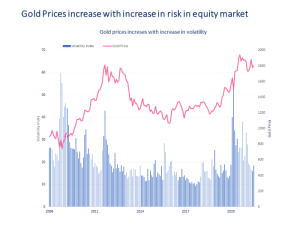

Market volatility analysis with AI involves using advanced algorithms to predict fluctuations in the market. These AI models can analyze vast amounts of data and patterns to forecast potential volatility in the stock market, forex market, or other financial markets.

Factors Considered by AI Algorithms

- Historical Price Data: AI algorithms analyze historical price movements to identify trends and patterns that may lead to volatility.

- Market News and Sentiment Analysis: AI models can process news articles, social media sentiments, and other sources to gauge market sentiment and potential impact on volatility.

- Market Indicators and Economic Data: AI algorithms consider various market indicators and economic data releases to assess the overall market conditions and predict potential volatility.

- Volatility Index: AI models may also incorporate volatility index data to understand the current market volatility levels and make predictions for the future.

Impact on Investment Decisions

Market volatility analysis with AI can significantly impact investment decisions by providing traders and investors with crucial insights into potential market movements. By predicting volatility, AI models can help investors make more informed decisions, adjust their risk management strategies, and capitalize on opportunities presented by volatile market conditions. This analysis can also assist in optimizing portfolio diversification and asset allocation to mitigate risks associated with market fluctuations.

In conclusion, AI in financial market analysis stands as a beacon of innovation, propelling us towards a future where data-driven precision guides our financial endeavors with unprecedented clarity and confidence.

Essential Questionnaire

How do AI algorithms benefit financial market analysis?

AI algorithms enhance analysis by swiftly decoding vast amounts of data, identifying patterns, and providing accurate predictions.

What examples of AI tools are commonly used in financial market research?

Popular AI tools include sentiment analysis algorithms, predictive analytics software, and machine learning models tailored for financial data interpretation.

How does AI predict market volatility?

AI models predict volatility by evaluating factors such as historical data trends, market sentiment, and external events impacting financial markets.