Embark on a journey through the realm of Cryptocurrency market analysis tools, exploring the significance of these tools and the key features to consider. Dive into the world of market analysis with this informative guide.

Overview of Cryptocurrency Market Analysis Tools

Cryptocurrency market analysis tools play a crucial role in helping investors make informed decisions in the volatile and fast-paced crypto market. These tools provide valuable insights, trends, and data that can assist traders in predicting price movements and identifying potential opportunities.

Popular Tools for Analyzing the Cryptocurrency Market

- CoinMarketCap: A widely used platform that offers real-time data, charts, and market capitalization of various cryptocurrencies.

- TradingView: Known for its advanced charting tools, technical analysis, and social networking features for traders.

- CoinGecko: Provides comprehensive cryptocurrency data, market analysis, and coin rankings based on developer activity, community, and liquidity.

Key Features to Look for in Cryptocurrency Market Analysis Tools

- Real-time Data: Ensure the tool provides up-to-date information on prices, trading volume, and market trends.

- Charting Capabilities: Look for tools with advanced charting features for technical analysis and price tracking.

- Portfolio Management: Tools that offer portfolio tracking and management functionalities can help users monitor their investments effectively.

- News and Analysis: Access to news updates and market analysis can be beneficial for staying informed about the latest developments in the crypto space.

- Alerts and Notifications: Tools that offer customizable alerts and notifications for price movements and market events can help users act promptly.

Types of Cryptocurrency Market Analysis Tools

When it comes to analyzing the cryptocurrency market, there are different types of tools available to investors and traders. These tools can help in making informed decisions and maximizing profits in this volatile market.

Technical Analysis Tools vs. Fundamental Analysis Tools

Technical analysis tools focus on historical price data and trading volume to predict future price movements based on patterns and trends. These tools include indicators such as Moving Averages, Relative Strength Index (RSI), and Bollinger Bands. On the other hand, fundamental analysis tools evaluate the intrinsic value of a cryptocurrency by analyzing factors such as project team, technology, market demand, and competition.

These tools help investors determine the long-term potential of a digital asset.

Benefits of Using Sentiment Analysis Tools

Sentiment analysis tools monitor social media, news articles, and forums to gauge the market sentiment towards a particular cryptocurrency. By analyzing public opinion and emotions, investors can better understand market trends and make timely decisions. These tools can help traders identify potential buying or selling opportunities before the market reacts.

Automated Trading Bots vs. Manual Analysis Tools

Automated trading bots are software programs that execute trades automatically based on predefined criteria and algorithms. These bots can trade 24/7, react quickly to market changes, and eliminate human emotions from trading. On the other hand, manual analysis tools require human intervention and decision-making. While manual analysis allows for more flexibility and control, it can be time-consuming and prone to human error.

Traders need to weigh the benefits and drawbacks of each approach based on their trading style and preferences.

Market Research in Cryptocurrency Analysis

Market research plays a crucial role in understanding the dynamics of the cryptocurrency market and making informed decisions. By analyzing data from various sources and historical trends, investors and analysts can gain valuable insights into market behavior.

Process of Conducting Market Research

Market research in the cryptocurrency industry involves collecting and analyzing data to identify trends, patterns, and potential opportunities. This process typically includes:

- Monitoring price movements and trading volumes of different cryptocurrencies

- Studying market sentiment through social media channels and forums

- Analyzing regulatory developments and news impacting the market

- Examining the performance of different blockchain projects and their tokens

Data Sources for Cryptocurrency Market Research

There are several data sources commonly used for cryptocurrency market research, including:

- Cryptocurrency exchanges for real-time price data

- Coinmarketcap and CoinGecko for market capitalization and trading volume information

- Blockchain explorers for tracking transactions and network data

- Social media platforms like Twitter and Reddit for gauging market sentiment

Role of Historical Data Analysis

Historical data analysis is essential in market research for cryptocurrencies as it provides insights into past market behavior and trends. By studying historical price movements, trading volumes, and market cycles, analysts can make informed predictions about future market movements. Historical data analysis helps in identifying patterns and correlations that can guide investment decisions and risk management strategies.

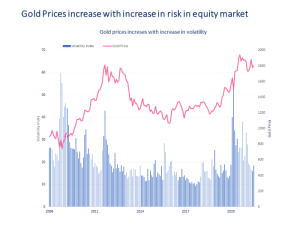

Analyzing Market Volatility with Tools

Market volatility plays a significant role in the cryptocurrency market, influencing prices and trading decisions. Understanding and analyzing market volatility is crucial for investors and traders to make informed choices and manage risks effectively.

Impact of Market Volatility in Cryptocurrency

Market volatility in cryptocurrency refers to the rapid and unpredictable price fluctuations that can occur within a short period. This volatility can be influenced by various factors such as market demand, regulatory developments, technological advancements, and global economic conditions.

- Volatility can lead to significant price swings, offering both opportunities and risks for traders.

- High volatility can attract speculative traders looking to capitalize on price movements.

- Excessive volatility may indicate market uncertainty and risk aversion among investors.

- Volatility can impact trading volumes, liquidity, and overall market sentiment.

Methods for Analyzing Market Volatility

Analyzing market volatility requires the use of specialized tools and indicators to measure and predict price movements. Traders and analysts rely on a combination of technical analysis, fundamental analysis, and market sentiment to assess volatility accurately.

- Volatility Index: Measures the expected volatility in the market based on option prices.

- Bollinger Bands: Indicates potential price breakouts by plotting standard deviations around a moving average.

- Relative Strength Index (RSI): Identifies overbought or oversold conditions in the market, signaling potential reversals.

- Historical Volatility: Calculates the past price movements of an asset to predict future volatility levels.

By using these tools effectively, traders can enhance their decision-making process and manage risks associated with market volatility.

In conclusion, understanding the various types of analysis tools, conducting market research, and analyzing market volatility are crucial aspects of navigating the cryptocurrency market effectively. Equip yourself with the right tools and knowledge to make informed decisions in this dynamic industry.

Detailed FAQs

What are the key features to look for in cryptocurrency market analysis tools?

Key features to consider include real-time data analysis, customizable indicators, user-friendly interface, and reliable historical data.

How do sentiment analysis tools benefit cryptocurrency market analysis?

Sentiment analysis tools help traders gauge market sentiment to make informed decisions based on emotional responses in the market.

What is the role of historical data analysis in cryptocurrency market research?

Historical data analysis allows traders to identify patterns, trends, and potential market movements based on past performance.