Starting with the Impact of inflation on market trends, this paragraph aims to draw readers in with an intriguing overview of how inflation shapes market dynamics.

Exploring the intricate relationship between inflation and various market aspects, this topic delves into the core factors driving economic trends.

Impact of inflation on market trends

Inflation is a critical factor that significantly influences various market trends, ranging from consumer behavior to interest rates and stock market performance.

Consumer Purchasing Power

Inflation erodes the purchasing power of consumers as the cost of goods and services increases. This results in consumers being able to afford fewer goods with the same amount of money. For example, if inflation rises by 3% and your income remains the same, you effectively have 3% less purchasing power than before.

Interest Rates

Inflation plays a key role in determining interest rates in the market. When inflation rises, central banks may increase interest rates to control the money supply and curb inflation. Higher interest rates make borrowing more expensive, which can slow down economic growth. Conversely, during periods of low inflation, central banks may lower interest rates to stimulate borrowing and spending.

Stock Market Performance

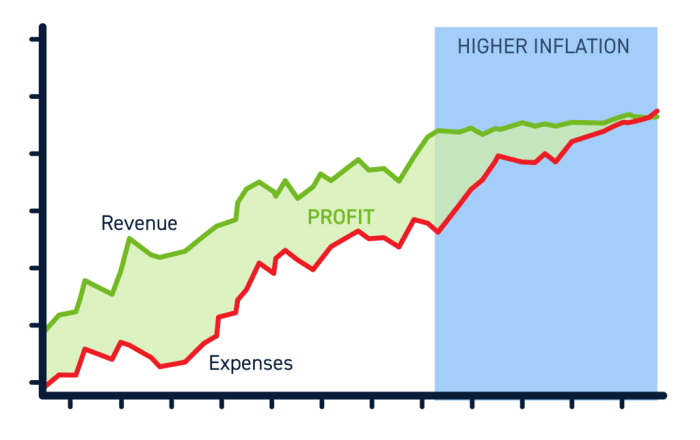

Inflation can impact stock market performance in various ways. While moderate inflation can be a sign of a healthy economy, high inflation can lead to uncertainty and volatility in the stock market. Companies may struggle to maintain profit margins, leading to potential decreases in stock prices.

Commodity Prices and Demand

Inflation also affects commodity prices and demand in the market. As the cost of production increases due to inflation, companies may pass on these higher costs to consumers, resulting in higher prices for commodities. This can impact demand as consumers may cut back on purchases of certain goods and services, leading to shifts in market dynamics.

Market analysis

Market analysis is a crucial process for businesses to understand the current market trends and identify opportunities for growth. It involves a systematic evaluation of various factors that can impact a company’s performance in the market.

Process of conducting a thorough market analysis

Market analysis begins with collecting relevant data on the industry, competitors, customers, and overall economic conditions. This data is then analyzed to identify patterns, trends, and opportunities that can help businesses make informed decisions.

- Conducting market research to gather data on customer preferences, buying behavior, and market trends.

- Assessing the competitive landscape to understand the strengths and weaknesses of competitors.

- Analyzing industry reports, economic indicators, and market forecasts to predict future trends.

- Utilizing tools like SWOT analysis to identify internal strengths and weaknesses, as well as external opportunities and threats.

Identifying market trends and opportunities

Identifying market trends and opportunities is essential for businesses to stay competitive and adapt to changing market conditions. By analyzing data and conducting research, companies can uncover new opportunities for growth and development.

- Monitoring consumer behavior and preferences to anticipate changing demands in the market.

- Identifying emerging technologies and innovations that can disrupt the market and create new opportunities.

- Exploring untapped market segments or niche markets that offer growth potential.

- Collaborating with industry experts and thought leaders to gain insights into upcoming trends and opportunities.

Importance of market analysis in strategic decision-making for businesses

Market analysis plays a vital role in strategic decision-making for businesses by providing valuable insights into market dynamics, customer preferences, and competitive landscape. It helps businesses make informed decisions and develop effective strategies to achieve their goals.

- Identifying market gaps and unmet needs that can be addressed through product development or marketing initiatives.

- Evaluating the potential risks and challenges in the market to mitigate threats and capitalize on opportunities.

- Aligning business goals and objectives with market trends to ensure long-term success and sustainability.

- Adapting strategies in response to changing market conditions and consumer behavior to maintain a competitive edge.

How market analysis helps in understanding customer behavior and preferences

Market analysis provides businesses with valuable insights into customer behavior and preferences, allowing them to tailor their products and services to meet the needs of their target audience effectively. By understanding customer preferences, businesses can enhance customer satisfaction and loyalty, ultimately leading to increased sales and profitability.

- Segmenting target markets based on demographic, psychographic, and behavioral factors to better understand customer needs.

- Gathering feedback from customers through surveys, focus groups, and social media to identify areas for improvement and innovation.

- Tracking purchasing patterns and trends to anticipate changes in consumer behavior and adjust marketing strategies accordingly.

- Personalizing marketing campaigns and messages to resonate with customers and create a stronger emotional connection with the brand.

Market research

Market research plays a crucial role in understanding consumer behavior, market trends, and competitive landscape. By utilizing different methods, businesses can gather valuable insights to make informed decisions. Let’s delve into the specifics of market research.

Differentiate between primary and secondary market research methods

Primary market research involves collecting data directly from the source through surveys, interviews, focus groups, or observations. On the other hand, secondary market research relies on existing data from sources such as reports, articles, and databases. While primary research provides firsthand information, secondary research offers a broader perspective based on existing data.

Explain how market research helps in identifying competitors and market positioning

Market research enables businesses to analyze competitors’ strengths and weaknesses, identify market gaps, and determine their unique selling propositions. By understanding competitor strategies and market positioning, companies can tailor their products or services to meet consumer needs effectively.

Discuss the role of market research in product development and innovation

Market research guides product development by gauging consumer preferences, identifying emerging trends, and evaluating market demand. Through feedback and insights gathered from research, businesses can innovate and create products that resonate with their target audience, leading to competitive advantage and growth.

Analyze the impact of market research on creating effective marketing strategies

Market research forms the foundation for developing effective marketing strategies by providing valuable data on target demographics, consumer behavior, and market trends. With insights from research, businesses can tailor their messaging, pricing, and distribution channels to effectively reach and engage their target audience, ultimately driving sales and brand loyalty.

Market volatility

Market volatility refers to the rate at which the price of a security or market index fluctuates over time. It is a measure of the risk and uncertainty in the market, impacting investment decisions significantly.

Impact on investment decisions

Market volatility can lead to rapid and unpredictable changes in asset prices, making it challenging for investors to gauge the value of their investments accurately. This uncertainty often prompts investors to reassess their risk tolerance and adjust their portfolios accordingly.

- Increased volatility can result in higher trading costs and potentially lower returns for investors.

- Investors may become more cautious and opt for safer investments during periods of high volatility.

- Short-term traders may take advantage of market fluctuations to capitalize on price movements.

Factors contributing to market volatility

Market volatility can be influenced by various factors, including economic indicators, geopolitical events, market sentiment, and investor behavior.

- Economic data releases, such as GDP growth, inflation rates, and employment figures, can impact market volatility.

- Geopolitical tensions, trade disputes, and natural disasters can introduce uncertainty and volatility into the market.

- Market sentiment and investor behavior, such as fear and greed, can exacerbate volatility and lead to erratic price movements.

Strategies to manage risks

During periods of high market volatility, investors can employ various strategies to manage risks effectively and protect their portfolios.

- Diversification: Spreading investments across different asset classes can help reduce overall risk exposure.

- Stop-loss orders: Setting predetermined exit points can limit potential losses in volatile markets.

- Hedging: Using derivatives or options to offset potential losses from adverse market movements.

Role in shaping investor sentiment

Market volatility plays a crucial role in shaping investor sentiment and behavior, influencing decisions related to buying, selling, or holding investments.

- High volatility can lead to panic selling or irrational exuberance, driving market trends in the short term.

- Investor confidence may waver during periods of extreme volatility, impacting overall market stability.

- Perceived risks and uncertainties can deter investors from taking on new positions or increasing exposure to certain assets.

Wrapping up the discussion on Impact of inflation on market trends, the key takeaways highlight the significant influence inflation exerts on market behaviors and decision-making processes.

Questions Often Asked

How does inflation impact consumer purchasing power?

Inflation reduces the purchasing power of consumers as prices rise, making goods and services more expensive.

What is the relationship between inflation and stock market performance?

Inflation can affect stock market performance as rising prices may lead to increased interest rates, impacting investment decisions.

How does market analysis contribute to strategic decision-making for businesses?

Market analysis helps businesses identify trends, opportunities, and customer preferences, aiding in making informed strategic decisions.

What strategies can be employed to manage risks during periods of high market volatility?

Diversification, hedging, and staying informed about market conditions are some strategies to mitigate risks during volatile market periods.