Embark on a journey into the realm of Market Volatility in 2024: Predictions, where the intricate dance of economic forces shapes the landscape of uncertainty and opportunity.

Explore the historical patterns, future forecasts, and risk management strategies that will define the financial markets in the upcoming year.

Market Volatility Trends

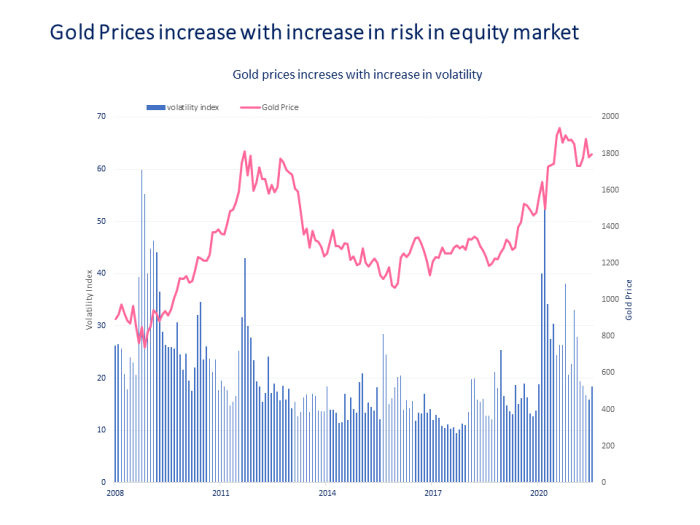

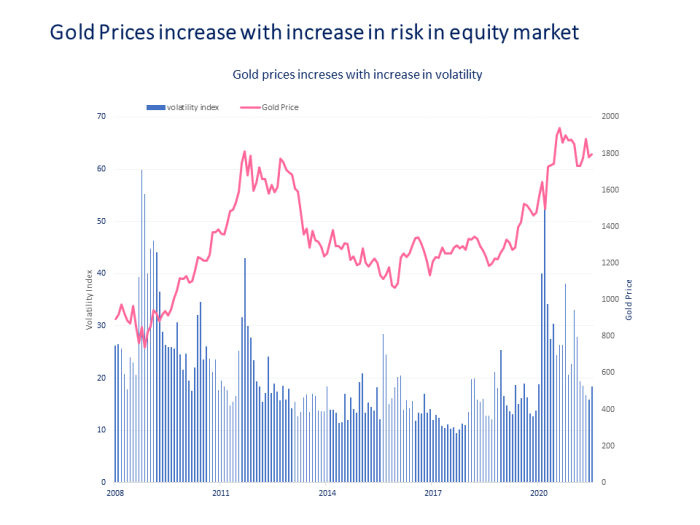

In the years leading up to 2024, market volatility has displayed various historical patterns influenced by a combination of factors such as economic conditions, geopolitical events, and investor sentiment. These trends have shaped the landscape of financial markets and impacted the behavior of assets across different sectors.

Key Factors Influencing Market Volatility

- The state of the global economy, including indicators like GDP growth, inflation rates, and employment figures, can have a significant impact on market volatility. Economic downturns or unexpected fluctuations in key metrics often result in heightened volatility as investors react to changing conditions.

- Geopolitical events, such as trade disputes, political instability, or conflicts, can create uncertainty in the markets and lead to increased volatility. The outcomes of elections, policy decisions, or diplomatic relations between countries can all contribute to fluctuations in asset prices.

- Technological advancements and innovations in financial markets have also played a role in shaping market volatility. High-frequency trading, algorithmic trading, and the use of complex financial instruments have introduced new sources of volatility that can amplify market movements.

Notable Events Impacting Market Volatility

- The COVID-19 pandemic in 2020 had a profound impact on market volatility, triggering widespread sell-offs and extreme price fluctuations across asset classes. Uncertainty surrounding the virus, government responses, and economic implications led to a period of heightened volatility that persisted for several months.

- The trade tensions between the United States and China in recent years have contributed to increased market volatility as investors reacted to shifting trade policies, tariffs, and negotiations between the two economic superpowers. The uncertainty surrounding the outcome of these trade disputes has created fluctuations in stock prices and currency values.

- The Federal Reserve’s monetary policy decisions, including interest rate changes and quantitative easing measures, have also influenced market volatility. Expectations regarding future Fed actions and their impact on inflation, borrowing costs, and economic growth can drive significant movements in asset prices.

Predictions for 2024

As we look ahead to 2024, several factors could potentially contribute to market volatility. Understanding these predictions is crucial for investors and analysts to navigate the uncertain financial landscape.

Potential Causes of Market Volatility

Various factors such as inflation, interest rates, global economic growth, and political instability can all play a role in triggering market volatility. Any unexpected shifts in these areas could lead to fluctuations in stock prices and market performance.

Projected Impact of Geopolitical Events

Geopolitical events, such as trade disputes, conflicts, or policy changes, have the potential to disrupt financial markets. Tensions between major economies or unexpected geopolitical developments can create uncertainty and instability, impacting investor confidence and market behavior.

Contribution of Emerging Technologies or Industries

The rapid advancement of technologies like artificial intelligence, blockchain, or renewable energy could introduce new opportunities and challenges to the market. Disruptions caused by emerging industries or technological innovations may lead to shifts in investment patterns and market dynamics, influencing volatility levels.

Economic Indicators

In the world of finance, economic indicators play a crucial role in helping forecast market volatility. These indicators provide valuable insights into the health of an economy, which in turn can impact the behavior of financial markets.Economic indicators come in various forms, including but not limited to GDP growth rates, unemployment figures, inflation rates, consumer confidence indices, and manufacturing output.

Each of these indicators offers unique information about different aspects of the economy, allowing analysts to make informed predictions about future market trends.

Impact of GDP Growth Rates

GDP growth rates are one of the most closely watched economic indicators as they reflect the overall health of an economy. High GDP growth rates are usually associated with a booming economy, leading to increased investor confidence and potentially lower market volatility. On the other hand, low or negative GDP growth rates can signal a recession, causing market volatility to spike.

Unemployment Figures and Market Volatility

Unemployment figures are another crucial economic indicator that can influence market volatility. High unemployment rates can lead to decreased consumer spending, lower corporate profits, and overall economic uncertainty, all of which can contribute to increased market volatility. Conversely, low unemployment rates are often seen as a positive sign for the economy, potentially leading to lower market volatility.

Inflation Rates and Market Behavior

Inflation rates also play a significant role in predicting market trends. High inflation rates can erode purchasing power, leading to reduced consumer spending and potentially higher interest rates, which can impact market volatility. Conversely, low inflation rates can indicate stable economic conditions, potentially resulting in lower market volatility.Overall, understanding and analyzing various economic indicators can provide valuable insights into market behavior and help investors navigate the complex world of finance with more confidence and foresight.

Risk Management Strategies

In the volatile market conditions of 2024, it is crucial for investors to implement effective risk management strategies to protect their investments and navigate uncertainty.Diversification is a key strategy that can help mitigate the impact of market fluctuations. By spreading investments across different asset classes, industries, and regions, investors can reduce their exposure to the risk of a single investment or sector.

This can help cushion the impact of a downturn in one area of the market, while potentially benefiting from the growth in another.

Importance of Contingency Planning

Contingency planning plays a vital role in managing risk in volatile market conditions. By preparing for potential scenarios and having a plan in place to address unexpected events, investors can minimize the impact of market shocks and uncertainties. This could involve setting up stop-loss orders, having cash reserves on hand, or diversifying investments further to protect against sudden market downturns.

As we conclude our exploration of Market Volatility in 2024: Predictions, it becomes evident that embracing volatility as a constant companion opens doors to innovative strategies and resilient decision-making in the ever-evolving financial world.

Questions and Answers

How can historical patterns help predict market volatility?

Studying historical trends provides valuable insights into how past events have influenced market behavior, offering a foundation for forecasting future volatility.

What role do geopolitical events play in market stability?

Geopolitical events can introduce sudden shifts in market sentiment and confidence, impacting volatility levels and investment decisions.

Why is diversification important in mitigating market fluctuations?

Diversification spreads risk across different assets, reducing exposure to the impact of a single market’s volatility on an entire portfolio.